banking Project management model

BPMM

Our model has matured based on our experience in large banking projects, where the key to success is a deep understanding of the business, the market, and the implementation of modern technologies.

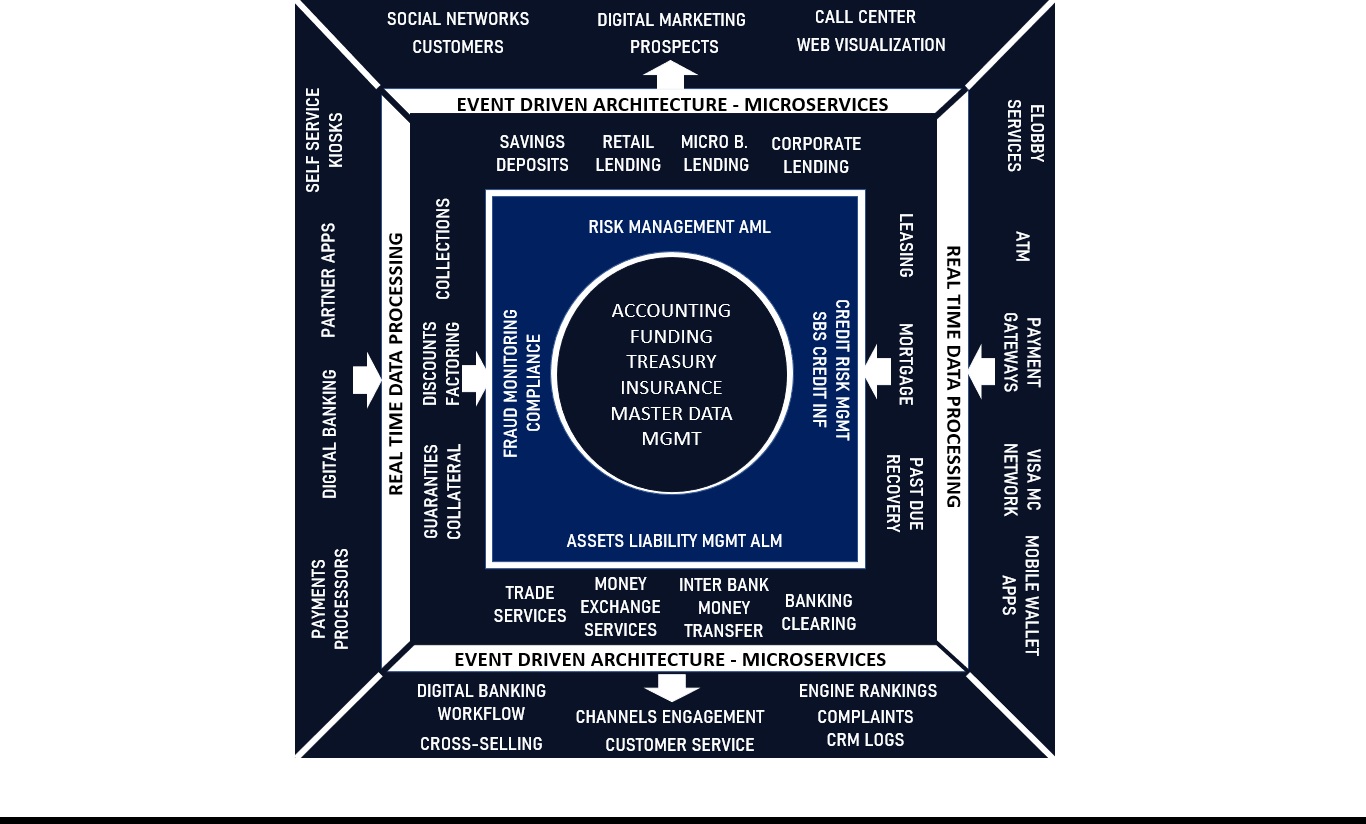

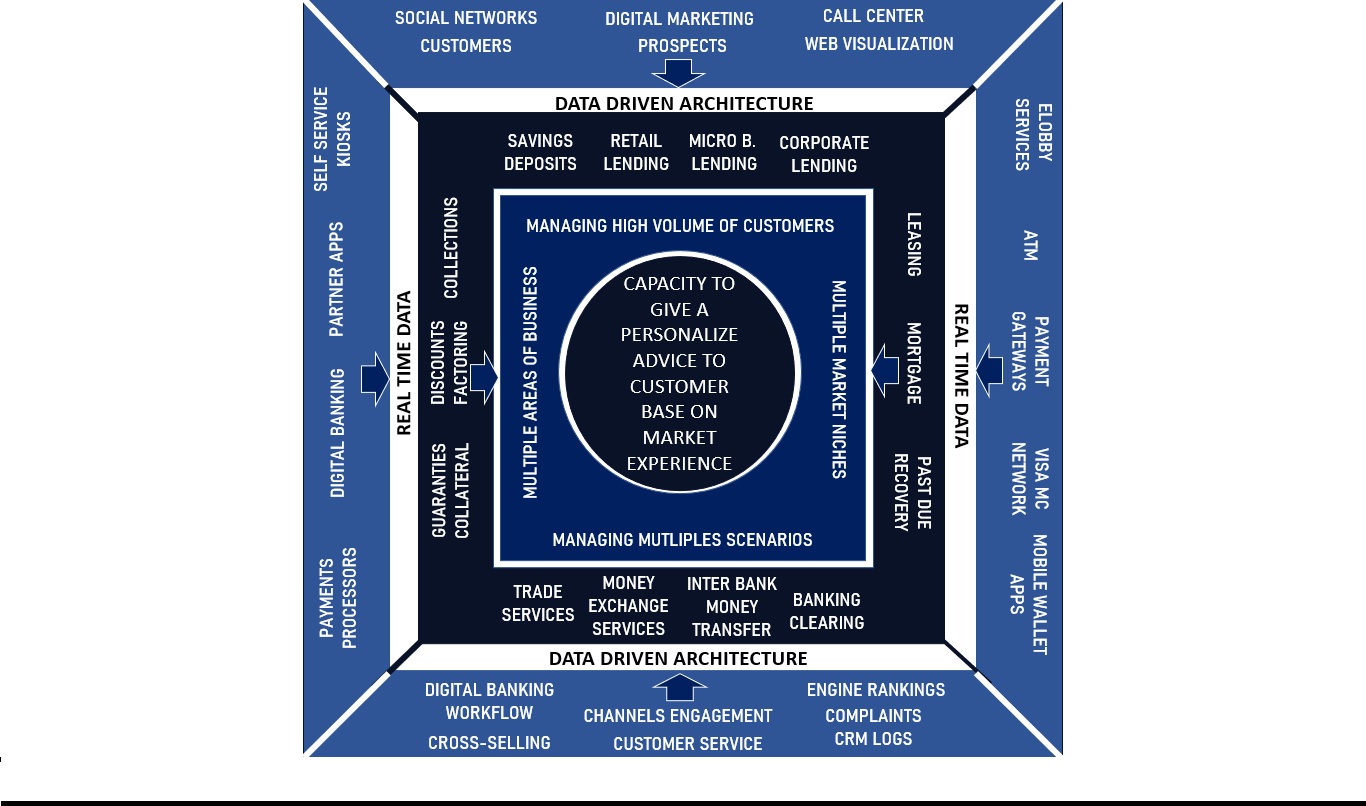

The BPMM model includes the combined application of real-time and event-driven processes for comprehensive information integration and the application of AI techniques to achieve the ability to provide personalized service in a highly segmented market at all levels.

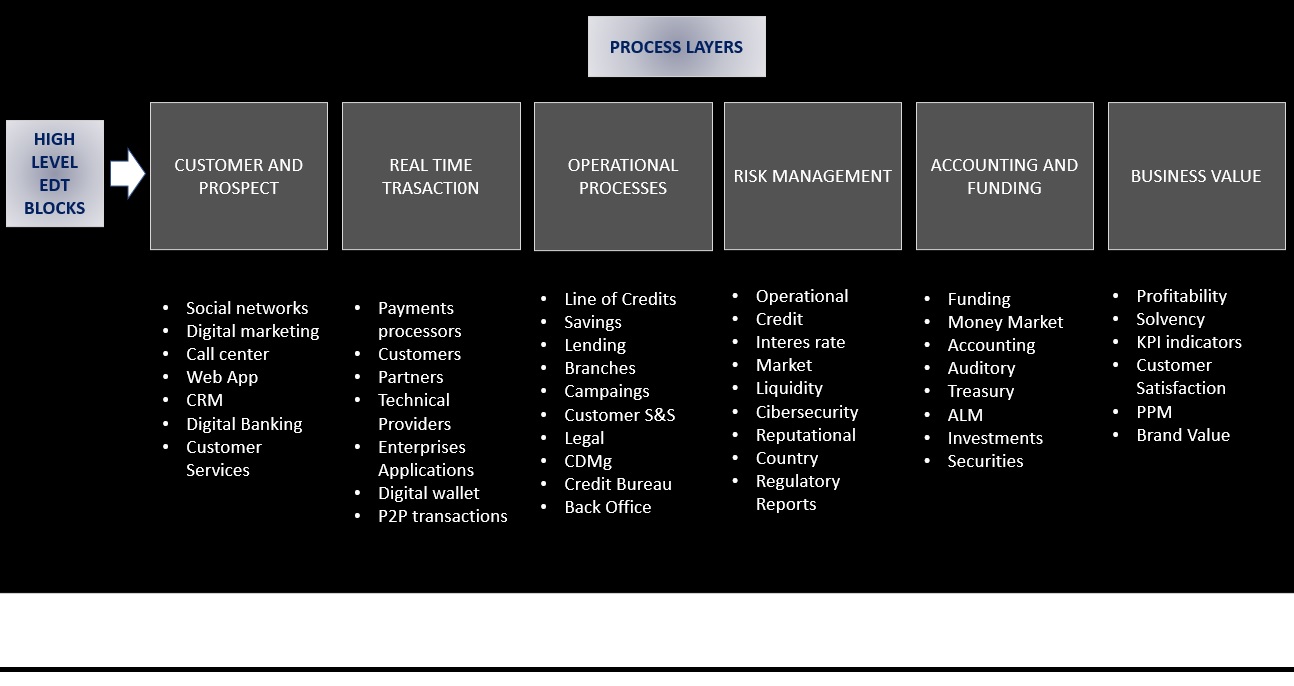

BPMM Processes Layers

By simultaneously outlining process and business levels, 6 layers of analysis are identified for the formation of work and control blocks.

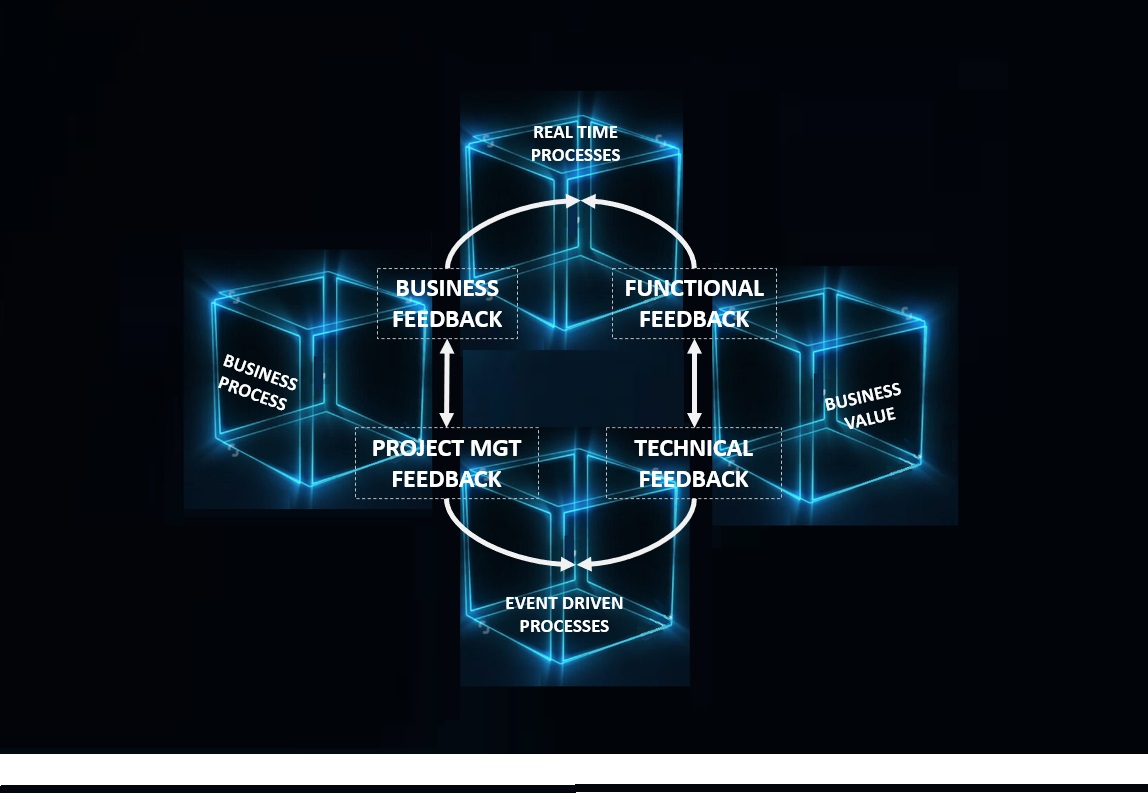

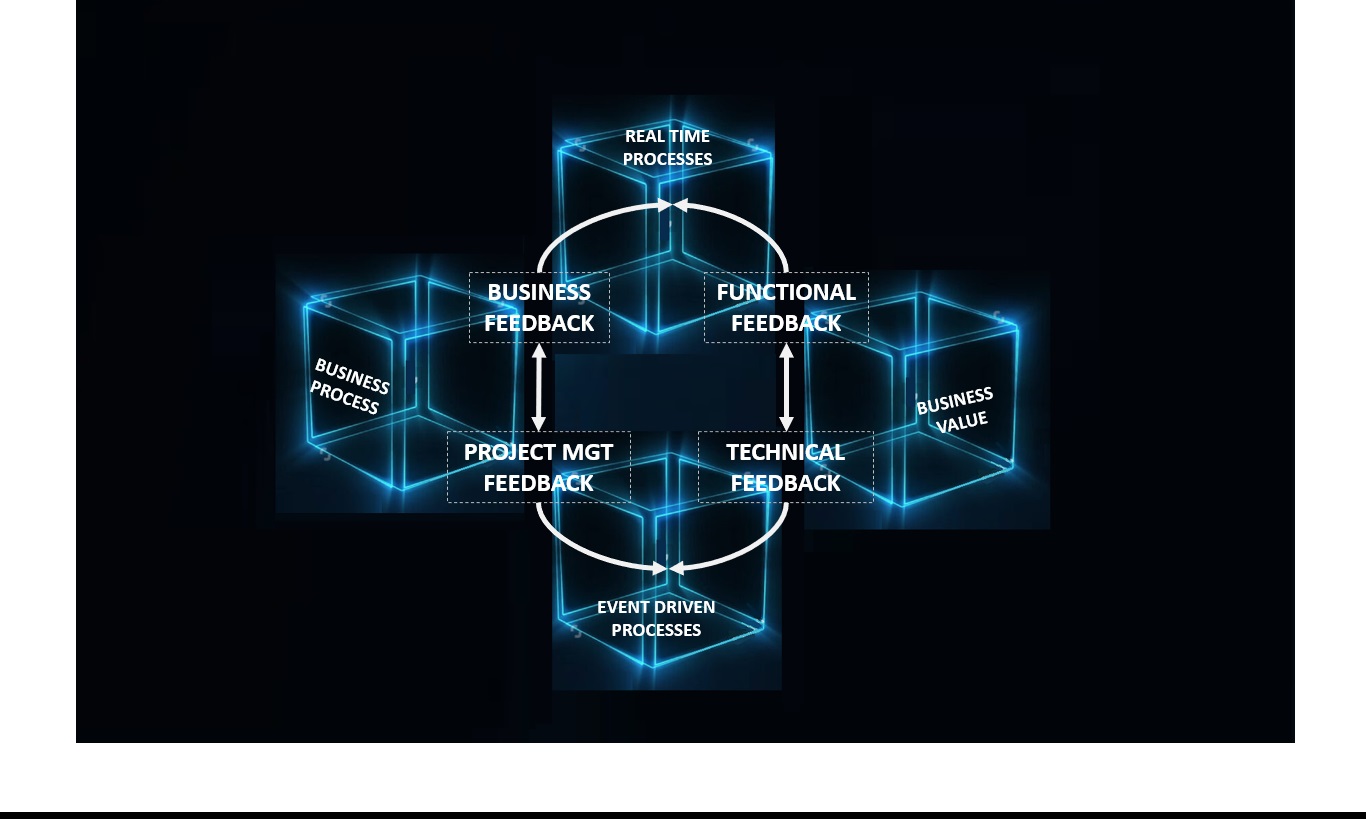

BPMM Feedback Advantage

BPMM guides us toward a continuous cycle of consolidating business and technical processes that will support innovation and successful project management. From a business perspective, we generate customized technology projects.

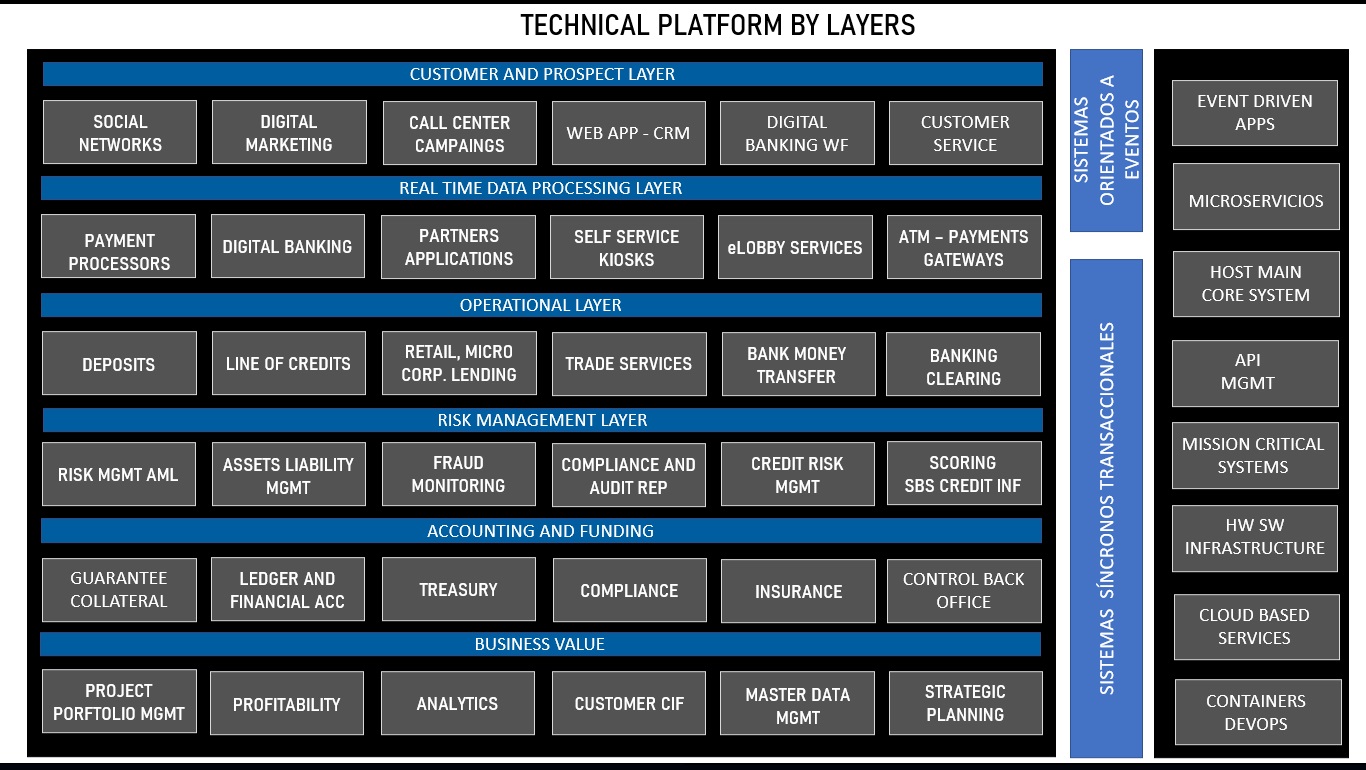

BPMM Project Layers

BPMM facilitates project management by grouping future work blocks according to the nature and type of information flow. The banking business requires a specialized team of experts to guide project planning and approach, dividing activities according to the financial product lifecycle—that is, taking a business-oriented approach.

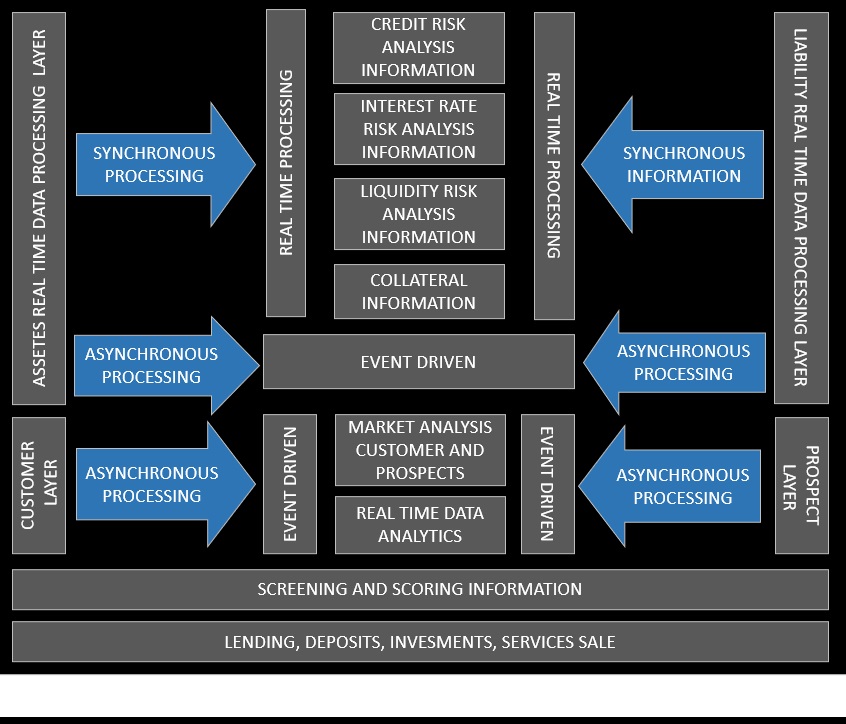

BPMM Information Flow

BPMM differentiates the type of information flow according to technical levels. For online transactions that run synchronously, for example, in an online payment system and are mission-critical, it classifies them as a first level. Information that flows internally to a marketing event capture system is classified as a second level. Information that feeds operational systems is classified as a third level.

BPMM Feedback

The analysis of information levels that enables the calculation of risks and profitability will allow for the development of customized product proposals based on market segments. The structure of information with a comprehensive approach and the use of modern analytical techniques provides the entity with technical capacity.

BPMM Feedback Processes

The model enables a continuous feedback process between the different layers of information processes to achieve scope for process or product innovation projects based on reliable information.

BPMM Real Time + Event Driven

The model applied to banking projects allows for the identification of key operational and risk analysis points that ensure profitability according to scale and market segments. The approach is based on the rigorous calculation of customer risk and profitability indicators based on comprehensive information about their interactions with the bank across different channels.

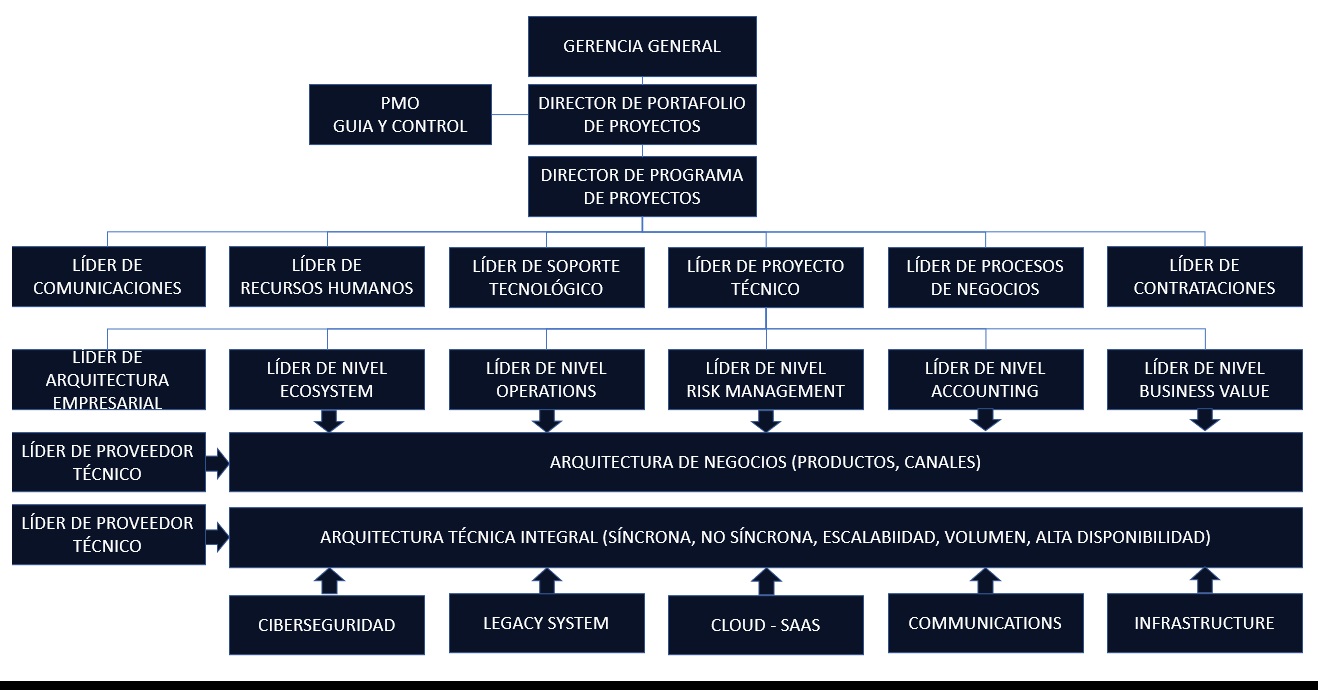

BPMM Project team

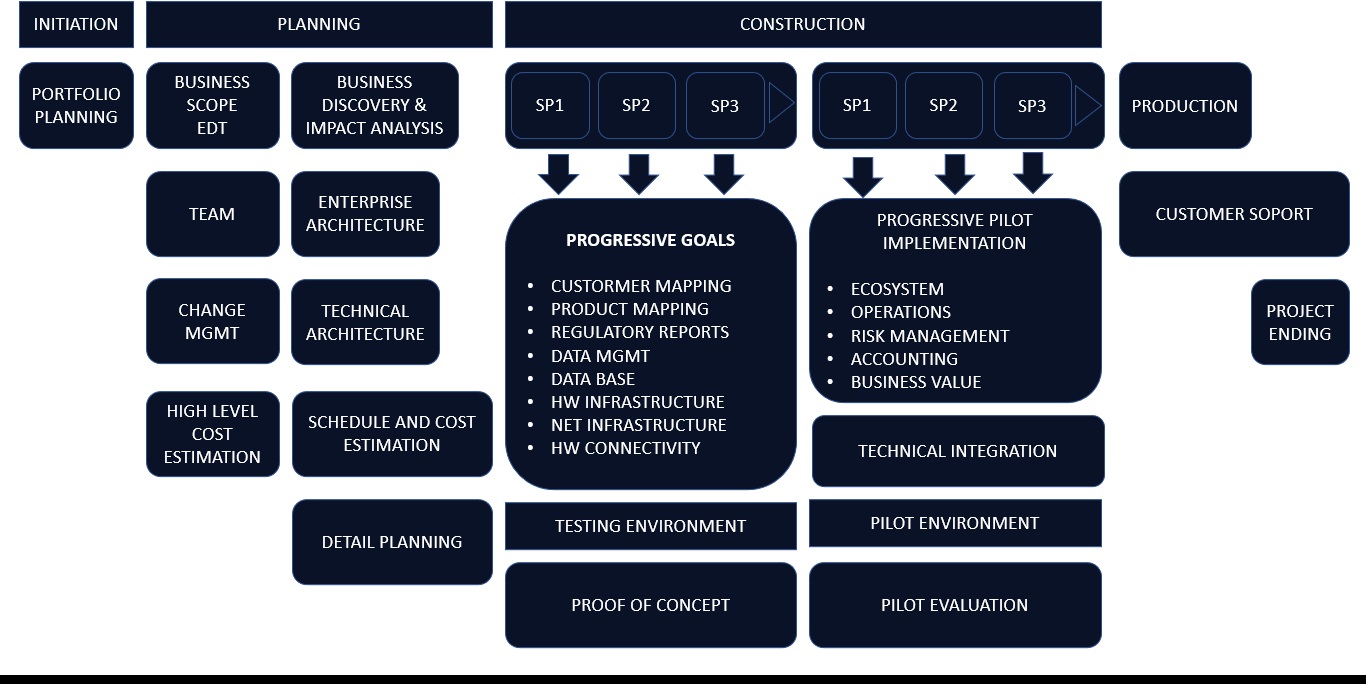

In the scenario of a core banking migration project, the winning strategy is to manage a project program under the leadership of a highly technical management center with multiple leaders who guide the organization to success with a focus on increasing business value.

BPMM Project Strategy

Managing complexity in a mission-critical environment and being responsible for managing public funds requires experience in successful projects, which is gained over time with the participation of expert teams committed to the institution. This is one of the principles that underpin our management proposal using the BPMM model.