AI-based credit scoring: Use cases and benefits

“In the complex realm of finance, liquidity access is paramount. It plays a pivotal role in personal life milestones such as acquiring housing, education, and vehicles and is equally crucial in entrepreneurship, affecting business initiation, growth, and expansion. Transactions involving lending and borrowing are fraught with uncertainties, influencing both creditors and potential debtors significantly. Creditors usually seek extensive information to gauge a borrower’s ability to fulfill loan obligations. Conversely, potential debtors navigate through a somewhat opaque process, where the criteria for approval are not always clear, making it difficult to improve their creditworthiness.

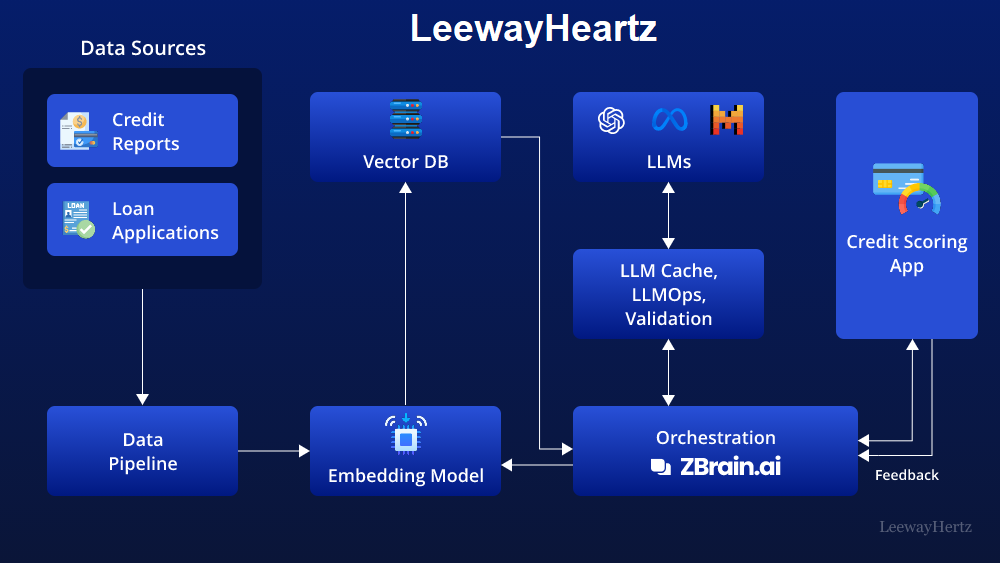

AI-based credit scoring emerges as a transformative solution in this landscape. It enables creditors to make more informed lending decisions by evaluating a borrower’s creditworthiness holistically. Unlike traditional methods, AI incorporates a multitude of data sources, such as online transactions and behavioral patterns. This approach allows AI algorithms to unearth patterns and correlations that might otherwise remain obscure, offering a nuanced and accurate depiction of an applicant’s creditworthiness. According to Polaris Market Research, the global market for credit scoring services is expected to reach USD 18.97 billion in 2022, projecting a compound annual growth rate of 24.06%.

This article aims to explore the intricacies of AI-based credit scoring, discussing its workings, benefits, applications, and real-world implementations. “Akash Takyar CEO LeewayHertz

AI in banking and finance: Use cases, applications, AI agents, solutions and implementation

AI in banking and finance offers various opportunities for process optimization, risk management, and customer engagement. One of the key areas where AI demonstrates its potential is in data analysis. AI has become increasingly popular in financial services, impacting how financial institutions operate, interact with customers, and manage day-to-day transactions and monetary regulations. The ability of AI to process vast amounts of data, identify patterns, and make informed decisions has made it a critical tool for banks and financial institutions. The banking and finance industry is data-driven, and AI can analyze vast amounts of data, providing insights that can help financial institutions make better decisions. There are many potential use cases for AI in banking and finance, including enhancing customer experiences, improving back-office operations, detecting fraud, managing risk, and improving compliance.

Google AI Banking

The four building blocks of responsible generative AI in banking

“The future of banking is generative. While headlines often exaggerate how generative AI (gen AI) will radically transform finance, the truth is more nuanced.

At Google Cloud, we’re optimistic about gen AI’s potential to improve the banking sector for both banks and their customers. We also believe that it can be done in a responsible manner.

There’s work to be done to ensure that this innovation is developed and applied appropriately. This is the moment to lay the groundwork and discuss—as an industry—what the building blocks for responsible gen AI should look like within the banking sector.” Google Financial Services.

IBM research insights

2025 Global outlook for Banking and Financial Market

Elevate banking performance in the age of AI

“As we enter 2025, the banking sector faces a critical juncture, balancing a unique confluence of new challenges and opportunities that will define its evolution over the next decade. Over the past 15 years, the aftershocks of the 2008 Global Financial Crisis,ever-tightening regulatory pressures, low interest rates, and fierce competition from both traditional and nontraditional rivals have constrained banks’ degrees of freedom. This convergence has created an environment where profitability is under pressure,cost-to-income ratios are elevated, and price-to-book ratios remain strained. ” IBM Institute for Business Value | Research Insight

Microsoft for Banking

The future of banking in the era of AI

Generative AI is transforming banking

“In financial services, there’s heightened interest in how artificial intelligence (AI) can drive improvements in managing risk and generating returns. Technology continues to play a central role in addressing financial, regulatory, and competitive challenges, and AI has the potential to help banks transform employee productivity, operations, and customer experiences. Generative AI unlocks intelligent banking and creates possibilities to innovate for business value faster.

There’s a reason it’s considered transformative. AI presents great potential compared to other technologies currently available. The AI era has already begun—we’re in it. Customers want personalized, custom products and services. Employees are looking to work more efficiently. AI provides the capabilities to make that possible for everyone who taps, swipes, or clicks.” Microsoft.