core Banking -Kafka

We’re sharing a presentation from “Confluent” about the new paradigm for applying event-driven architectures using Kafka in the banking ecosystem. As we well know, for the past 30 years, banking has been using large centralized mainframe systems with the participation of intermediary companies to manage financial and transactional flows (switching and acquiring), using synchronous technology that doesn’t allow for the substantial changes required by today’s competitive environment. In this context, asynchronous technologies offer the long-awaited solution.

SBS core banking

“As the financial services industry continues to evolve, the onus is on banks to keep up. Meeting the needs of today’s ever-demanding customers means offering the latest, most innovative, hyper-personalized products and services. But without a modern core banking solution, incumbents struggle to compete with younger, more tech-focused, agile entrants.

Indeed, over a third of banks (34%) surveyed say issues with core banking systems are the biggest challenge they face around developing a digital ecosystem of products and services, per a former edition of our Digital Banking Experience (DBX) Report.” SBS Platform.

Tememos

“Temenos core banking is the most successful and widely used digital core-banking solution in the world. Using cloud native and agnostic technology, Temenos provides the most extensive and richest set of banking functionality across retail, corporate, treasury, wealth and payments with over 1000 banks in 150+ countries relying on it to provide market leading and innovative products and services to their customers.” Tememos.

SmartVista BPC

“Digital banking in a Super App environment is a complex yet rewarding way of expanding

your client offerings. As well as requiring state-of-the-art technical knowledge, you need to be

confident that everything is taken into account, from trends and behaviours to responsibilities

and liabilities. BPC builds, launches, onboards, and maintains large marketplace environments,

and we have exactly what it takes to build yours.” BPC.

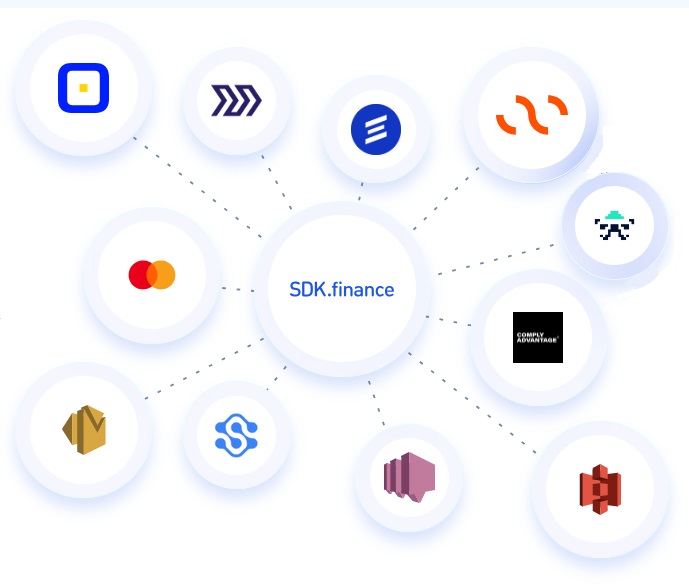

SDK.finance

Deliver solutions for top-notch payments and banking products

“For almost 10 years, SDK.finance has been providing core fintech banking and payment engine to serve as a software shortcut for businesses looking to launch their fintech products, from digital wallets to neobanks, accommodating startups and enterprise-level customers. Back in 2013, with a few successfully launched fintech projects behind, and having walked in the fintech entrepreneurs’ shoes, we realized that developing each project from scratch was too time- and resource-consuming. Finding a team with a decent experience in digital payment software was incredibly challenging, and talents retention and product development itself were not easier.” SDK.finance

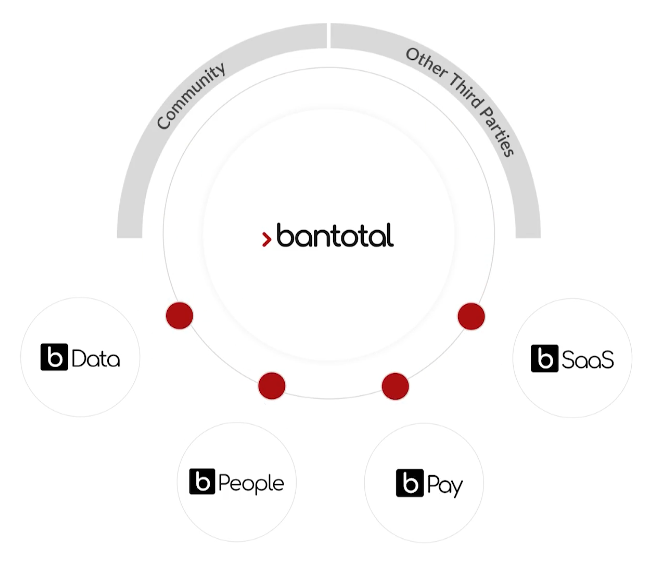

Bantotal

One of the most used core banking in LA

“Its core systems are the basis for the operation fo the financial institution. At the centre, the customer system, general parameters system, price administration system, account system, tax system, transactional system, process form system, authorization system and integratin system with external applications and distribution channels. These core systems support the functional processess and banking products with a power accountant module that facilitates the online operative and accountant reconciliation.” Bantotal.

Oracle Flexcube

Build, expand, and scale offerings

“Comprehensive product portfolio

Quickly launch and manage a range of products across deposits, lending, and microverticals like Islamic banking, microfinance, and financial inclusion.

Centralized product administration

Easily manage large portfolios of products and offerings and scale efficiently across the banking enterprise.

Extensive parameterization, multiple localizations

Design and customize tailor-made products and offerings for customers and markets.

Relationship based pricing

Roll out customized and enticing pricing options for products and offerings.” Oracle.

Topaz Financial core

Digital Core - Microfinance

“Lidera la transformación en el sector financiero con nuestras soluciones de core bancario, caracterizadas por su arquitectura modular de última generación en la nube, con una escalabilidad y configurabilidad incomparable, aportando mayor competitividad a tu negocio.” Topaz.