Banking Projects

Decision makers have to challenge all the entity to achieve Successfull.

Every day, every time we are involved in projects to boost the business to new horizons, markets, technologies that always are defiing the future with experience and new methodologies.

This Web site tries to inform about succesfull technologie projects to review how to be winners.

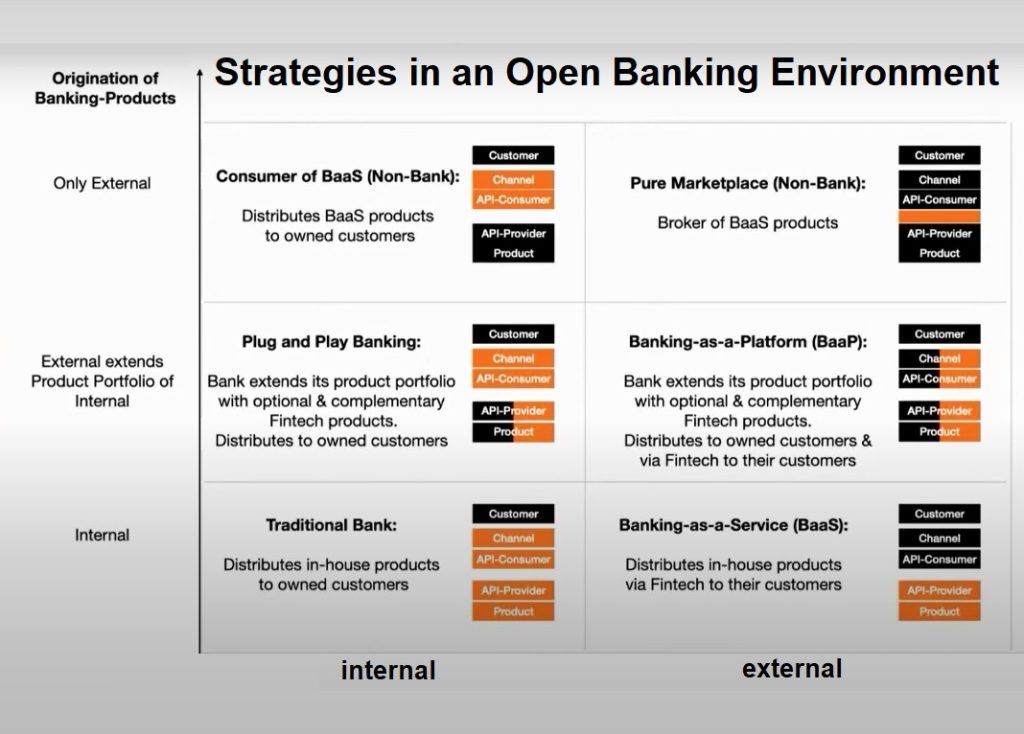

We need new strategies and Innovation in modelling banking to challenge all our knowledge and experience